top of page

Mortgage Guides & Insights

How Mortgage Overpayments Affect Your Next Remortgage Rate (UK)

Summary This article explains how mortgage overpayments work during fixed-rate periods in the UK, including early repayment charges, lender rules, and common limitations. It is for general information only. If you’re planning to remortgage, you may be wondering whether overpaying your mortgage now will help you secure a better interest rate later. The short answer is yes — mortgage overpayments can significantly affect your next remortgage rate, but not in the way many people

3 min read

Does Overpaying a Mortgage Reduce Your Monthly Payments or Term? (UK)

Summary This article explains how mortgage overpayments work during fixed-rate periods in the UK, including early repayment charges, lender rules, and common limitations. It is for general information only. When you overpay your mortgage, it’s natural to expect your monthly payments to fall. But in the UK, that isn’t always what happens. In reality, mortgage overpayments can reduce: Your mortgage term Your monthly payments Or sometimes both — depending on your lender and how

3 min read

What Happens to Mortgage Overpayments When You Remortgage? (UK)

Summary This article explains how mortgage overpayments work during fixed-rate periods in the UK, including early repayment charges, lender rules, and common limitations. It is for general information only. If you’ve been overpaying your mortgage, you may be wondering what happens to those overpayments when you remortgage. Do they disappear? Do they reduce your new loan? And can overpaying before remortgaging actually put you in a better position? In this guide, we explain ex

3 min read

Lump Sum vs Monthly Mortgage Overpayments – Which Saves More? (UK)

Summary This article explains how regular mortgage overpayments could affect interest costs and mortgage term length for UK homeowners. Examples are illustrative only and do not constitute financial advice. If you’re planning to overpay your mortgage, one of the most common questions is whether it’s better to make regular monthly overpayments or put down a lump sum when you have spare cash. Both approaches can reduce interest and shorten your mortgage term — but the differenc

4 min read

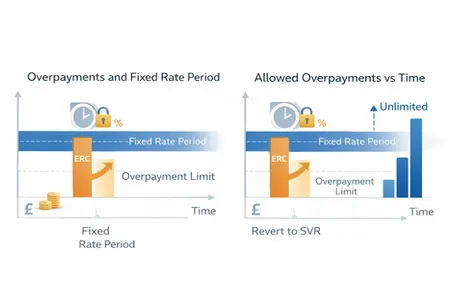

Can You Overpay a Mortgage During a Fixed Rate Period? (UK)

Summary This article explains how mortgage overpayments work during fixed-rate periods in the UK, including early repayment charges, lender rules, and common limitations. It is for general information only. If you’re on a fixed rate mortgage, you may be wondering whether you’re allowed to overpay — and if doing so could trigger early repayment charges. The good news is that most UK lenders do allow overpayments during a fixed rate period, but there are rules and limits you ne

3 min read

What is the UK Mortgage Overpayment Cap?

Summary This article explains how mortgage overpayments work during fixed-rate periods in the UK, including early repayment charges, lender rules, and common limitations. It is for general information only. Most UK mortgage lenders allow you to overpay your mortgage — but only up to a limit. This is known as the mortgage overpayment cap, and exceeding it can trigger early repayment charges (ERCs). Understanding how this cap works is essential if you want to reduce interest, s

4 min read

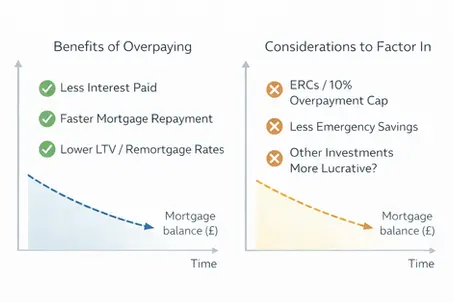

Mortgage Overpayments vs Savings Accounts

Summary This article explains how mortgage overpayments compare with saving money in a UK savings account, including interest rates, flexibility, and long-term cost impact. It is for general information only and does not provide financial advice. If you have spare money each month, should you overpay your mortgage — or put it into savings? This is one of the most common questions UK homeowners ask, and the answer depends on interest rates, risk, and flexibility. There’s no si

3 min read

How Much Can £100 a Month Save on Your Mortgage?

Summary This article explains how regular mortgage overpayments could affect interest costs and mortgage term length for UK homeowners. Examples are illustrative only and do not constitute financial advice. £100 a month doesn’t feel like much — but when it comes to your mortgage, it can make a surprisingly large difference. Many UK homeowners are shocked by how powerful small, consistent overpayments can be over the long term, even when starting with modest amounts. Why small

3 min read

Is Overpaying Your Mortgage Worth It in the UK?

Summary This article explains factors that can affect whether mortgage overpayments may be beneficial for UK homeowners, including interest rates, personal finances, and flexibility considerations. It does not provide personalised financial advice. Overpaying your mortgage is often described as one of the simplest ways to save money — but is it actually worth it for UK homeowners? The short answer: for many people, yes — but not in every situation. Understanding when overpayi

3 min read

bottom of page